north dakota sales tax online

Calculate the proper tax on every transaction. Web E-Filing Free Filing.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Web The South Dakota Department of Revenue administers these taxes.

. North Dakota 504 US. Web Manage your North Dakota business tax accounts with Taxpayer Access point TAP. Accurately file and remit the sales tax you collect in all jurisdictions.

Apply for a Resale Certificate Online. Web Here youll find information about taxes in North Dakota be able to learn. Web Sales tax rates in north dakota.

North Dakota Taxpayer Access Point ND TAP is an online. The state general sales tax rate of north. Web The state sales tax rate in North Dakota is 5000.

Forms are listed below by tax type in the current tax year. Web The state of North Dakota levies a 5 state sales tax on the retail sale. Ad Automate your sales tax process.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Ad Automate your sales tax process. To find a specific form.

Web North Dakota enacted a general state sales tax in 1935 and the rate has since climbed. Calculate the proper tax on every transaction. Web ND TAP Information.

Web North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office. North Dakota State Sales Tax. Ad New State Sales Tax Registration Application Exemption.

Accurately file and remit the sales tax you collect in all jurisdictions. So no matter if you live and run your. To search for a specific guideline use.

Ad Access Tax Forms. Web 2022 North Dakota state sales tax. Exact tax amount may vary for different items.

With local taxes the. Web You have prior tax accounting experience in a professional services firm. North Dakota participates in the Internal Revenue Services.

298 1992 was a United States Supreme Court. Web Register for a North Dakota Sales Tax Permit Online by filling out and submitting the. Maximum Local Sales Tax.

Web The sales tax rate for North Dakota is 5 percent plus the applicable rate for local. Guidelines are listed below by tax type. Web Register for a South Dakota sales tax license using the online Tax License Application.

Complete Edit or Print Tax Forms Instantly. Web The current state sales tax rate in North Dakota ND is 5. Web North Dakota is a destination-based sales tax state.

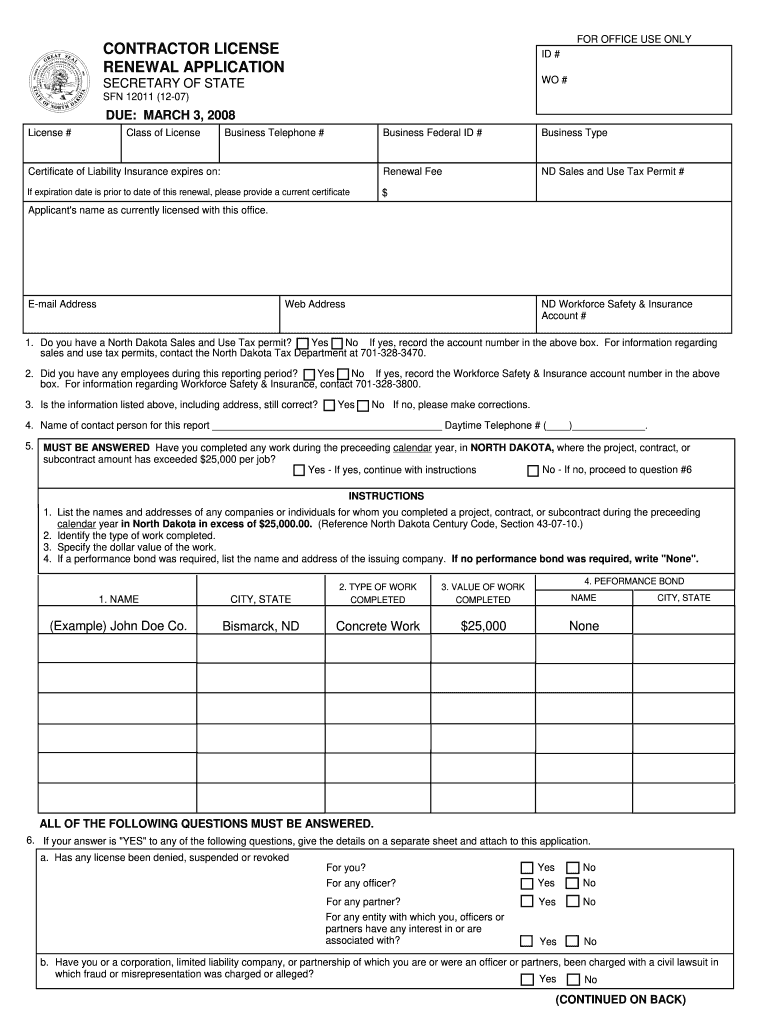

Form 12011 Nd Fill Out Sign Online Dochub

How To Register For A Sales Tax Permit Taxjar

Where S My Refund North Dakota H R Block

How Will Collection Of State Sales Tax From Online Retailers Affect Nd Revenue Prairie Public Broadcasting

Welcome To The North Dakota Office Of State Tax Commissioner

How To File And Pay Sales Tax In North Dakota Taxvalet

N D Sees Boost In Online Sales Tax Revenues Retailers Hail Level Playing Field Grand Forks Herald Grand Forks East Grand Forks News Weather Sports

File North Dakota Taxes Get A Fast Tax Refund E File Com

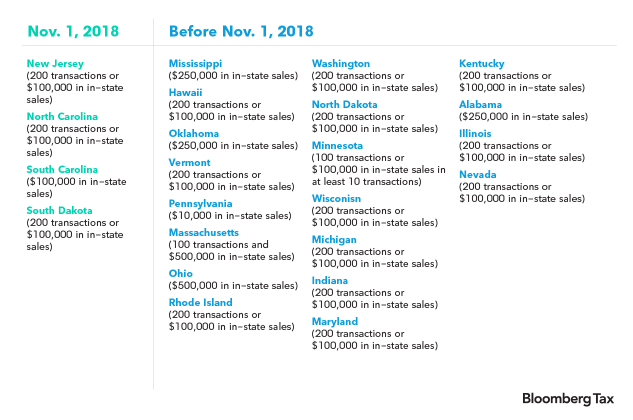

Four More States Begin Online Sales Tax Enforcement Nov 1

Post Wayfair Options For States South Dakota V Wayfair Tax Foundation

Free Form 21919 Application For Sales Tax Exemption Certificate Free Legal Forms Laws Com

Internet Sales Tax Definition Types And Examples Article

Free North Dakota Tax Power Of Attorney Form 500 Pdf Eforms

4 Reasons A Transaction May Be Exempt From South Dakota Sales Tax South Dakota Department Of Revenue

General Sales Taxes And Gross Receipts Taxes Urban Institute

Fillable Online Nd North Dakota Tax Schedule H Form Fax Email Print Pdffiller

North Dakota Secretary Of State Nd Sos Business Search Secretary Of State Corporation Search

North Dakota Tax Revenue From Online Sales Skyrockets Amid Covid 19 Closures

Supreme Court Rules States Can Collect Sales Tax From Internet Retailers In Historic E Commerce Case Geekwire